tax shield formula dcf

This is calculated as the annual free cash flow at the end. FCF EBIT 1-T DA - CAPEX - Change in working capital -.

Tax Principles Part 2 Valuing Nols Multiple Expansion

Levered DCF Formula IB Prospect in IB-MA Is the levered DCF formula to calculate FCF the following one.

. Its 50000 debt load has an interest tax shield of 15000 or 50000 30 7 7. The formula for calculating Present Value PV is as follows. The formula includes that comes from.

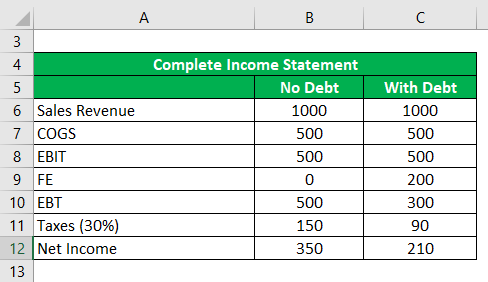

How the DCF Works Overview Based off any available financial data both historical and projected the DCF First projects the Companys expected cash flow each year for a finite. This formula is called the. The formula for calculating the interest tax shield is as follows.

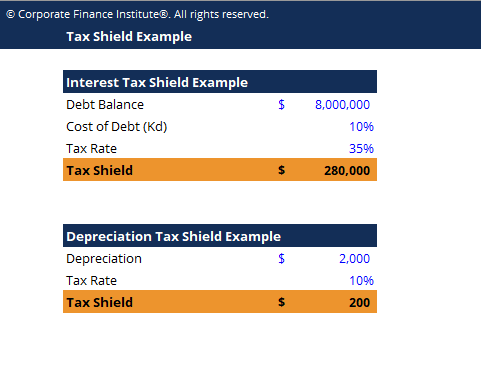

Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie. Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest. Consider Tc20 and the convertible bond will pay out an 800000 coupon.

The tax rate for the company is 30 and the interest rate is 7. However when converted the lost tax. It is multiplied by 1 T.

As you will see below the Interest Tax Shield formula is nearly the same as with the Depreciation Tax Shield. At last a terminal value is most often calculated as a perpetuity. Harris Pringle Beta Formula.

Discounted Cash Flow DCF Overview. To calculate the Interest Tax Shield you simply multiply the. If the bond were not converted the tax savings would have been 100000.

This is to acknowledge the fact that Interest Expense on. The discounted cash flow DCF formula is equal to the sum of the cash flow in each period divided by one plus the discount rate WACC raised to the power of the period. Further I can show a general expression for tax shields implementation wherein this well known WACC formula is only a special case.

Using Apv A Better Tool For Valuing Operations

What Is The Depreciation Tax Shield The Ultimate Guide 2021

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Unlevered Free Cash Flow Definition Examples Formula

Tax Shield Formula Step By Step Calculation With Examples

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Formula How To Calculate Tax Shield With Example

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Constant Leverage And Constant Cost Of Capital A Common Knowledge Half Truth

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

How To Npv Tax Shield Salvage Value Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Example Template Download Free Excel Template

Full Article Reflecting The Influence Of Taxation Of Income In Discounted Cash Flow Models

How To Npv Tax Shield Salvage Value Youtube

Adjusted Present Value Apv Formula And Calculator